Payment & Sales Tax

Also very important, you can take people's money using eCommerce. Like the shipping options, new payment gateways can have payment methods created for them and added to your site. Many popular popular and regional gateways are already in the marketplace.

Ecommerce comes with four payement methods: two authorize.net methods offering AIM or SIM authentication, the 'default' method which only sends the customer and seller emails so you can determine payment details yourselves, and paypal websites payment standard, which directs customers to paypal to finish checkout.

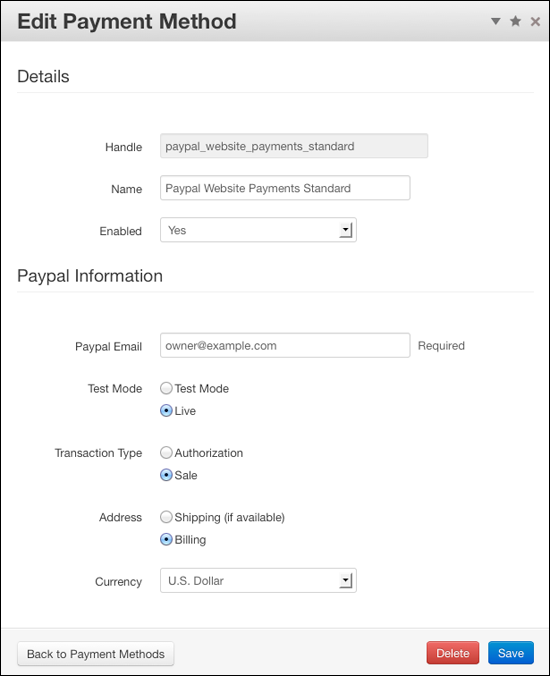

This is the website payments standard dialog. Its features are fairly common to all gateways.

You can change any payment method's name to be more friendly - "pay on paypal" etc - and set it to enabled or disabled.

The rest of the dialog will be specific to your chosen method, but typically it will ask for your user info, whether the transactions should be for real or not, whether the payment is an authorization or an actual sale and the currency you want to work in.

Sales Tax

The Payment & Sales Tax page is also where you can set up sales tax. You can add multiple kinds of sales tax. First, locate the Tax page. It's available in the tertiary dropdown nav on the Payment Methods page.

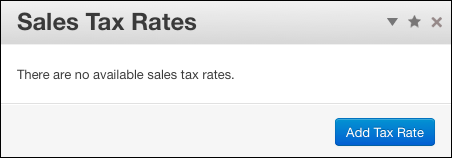

At first you may not have any tax rates set up. Click Add Tax Rate to create a new tax.

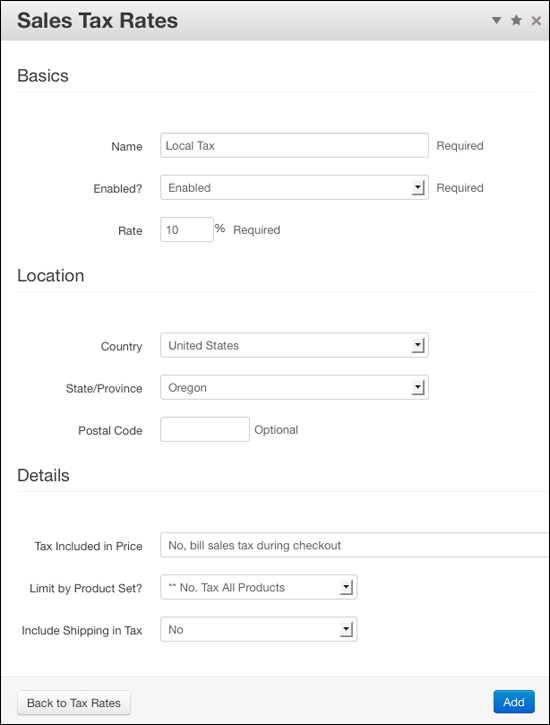

You can pick all the requirements for a sales tax rate here. If you have already priced your products to include the tax, the amount of the price that constitutes the tax can be shown to your customers while they are shopping if you pick yes. In addition, you can specify which state the tax applies to, and optionally include a zip code for even more specific regional targeting. You can also choose whether or not the shipping is taxable.

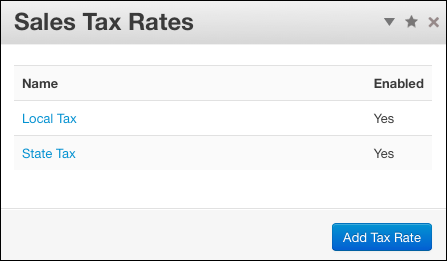

Multiple tax rates can be set up to handle different requirements.